There’s a deluge of new data and research to wade through in the mobile games business. Our regular data digest column breaks it all down into digestible chunks.

Read on for the numbers you need to know about minus the fluff.

This column is sponsored by Xsolla, which can help you to quickly launch your branded web shop to boost revenue and expedite your marketing ROI. Get started here.

GTA: San Andreas hits 25m downloads on Netflix

The Grand Theft Auto: San Andreas remaster released through Netflix in December 2023 has just passed 25m downloads, according to Appmagic estimates.

The LA-set game is way ahead of the other two GTA remasters Vice City (7.7m downloads to date via Netflix) and GTA III (3.6m) on the service.

Second in the rankings by downloads on Netflix is Annapurna’s Storyteller (14.3m downloads), followed by Tilting Point’s SpongeBob: Get Cooking (10.4m), Bloons TD 6 (9.8m) and Too Hot To Handle: Love is a Game 8.9m). There’s plenty more data on lifetime Netflix Games downloads here.

Love and Deepspace revenue spikes

Love and Deepspace revenue has shot up by over 90% in the last few months after big updates in late July and early August that added new datable characters.

GameRefinery data shows that the title’s monthly revenue rose up from below $400k (around $380k) in June to around $725k in the wake of the updates.

The Pokémon Company wins $15m lawsuit over mobile rip-off

Several Chinese companies are having to cough up $15m after the Pokémon Company won a copyright and IP lawsuit related to a mobile game called Pocket Monster Reissue.

As reported by gamesindustry.biz, which spotted a GamesBiz story translated by Automaton, The Pokémon Company won its case against the game for lifting its characters for use in Pocket Monster Reissue, which according to local reports was earning around $42m a year in China.

26.5% of IAP buyers will repurchase within 30 days

Over a quarter of people who buy an in-app purchase will do so again within 30 days. That’s according to Unity’s Mobile Growth and Monetization Report, which shows that 26.5% of the 1.83% of users who spend money in game will buy again within 30 days. Overall, 28.8% of those who have purchased an IAP will do so over their lifetime.

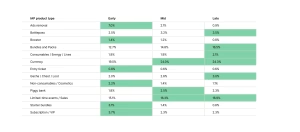

Throughout a game’s lifecycle, selling currency, bundles and limited events are the most effective ways to stimulate in-game spending (ignore the green highlighting above as it doesn’t seem to correlate to what the most popular methods are).

Throughout a game’s lifecycle, selling currency, bundles and limited events are the most effective ways to stimulate in-game spending (ignore the green highlighting above as it doesn’t seem to correlate to what the most popular methods are).

Looking at video ads, rewarded engagement is highest in word, RPG and casual titles with 38.4%, 37.6% and 36% of these audiences clicking through respectively.

Cypher Games raises $10m

PocketGamer.biz reports that Turkey’s Cypher Games has secured $10m in investment. This funding round was led by The Raine Group. The company plans to use this cash to fund development for a new match-3 title.

Zynga on the hook for $44.9m in damages

Zynga owner Take-Two has said that it lost a patent lawsuit brought against it by IBM. A jury found that the Farmville firm had infringed on two of the tech behemoth’s patents and thus IBM was owed $44.9m in damages. Take-Two has said it will be appealing the decision.

43% of mobile games use hybrid monetisation

Nearly half of mobile titles use a mix of in-app advertising and in-app purchases. That’s according to AppsFlyer’s recent State of Gaming App Marketing report, which shows that 43% of mobile titles use a mix of monetisation. That’s a 3% increase on Q4 2023 and a 7% increase on Q2 2023. 26% of hypercasual titles use hybrid monetisation, up on the 19% that used this nine months ago, while midcore rose from 41% to 51% in this period.

Consumer spending has dipped in the last nine months, too, on both Android and iOS. Meanwhile advertising rose 4% driven by a 12% increase from Android that helped offset a 10% dip from iOS.

The mobile games market brought in $29bn in app install ad spend during 2023, $12.1bn of which was in the United States. Of that figure, $6.6bn was spent on iOS, while $5.5bn was on Android. This is more than the next ten markets combined.

Meanwhile, the cost of media on iOS has dropped somewhat, though AppsFlyer reckons this is to do with a spike in cost during 2022 thanks to the introduction of App Tracking Transparency.

Indian mobile market to hit $734m in 2024

Niko Partners expects that India’s mobile games market will make $734m during 2024. That’s 77.9 per cent of the $942.4m total that the country’s industry will generate this year and a 14.7% increase on 2023. Niko reckons that by 2028, India’s games market will make $1.4bn, $1.1bn of which will come from mobile.

Female players spend 8.5% more per month on games than men, while 57% of mobile gamers in the country have played a battle royale title in the last three months, such as BGMI and Free Fire.

Magify lands €1m investment

As reported by Pocketgamer.biz, data and live ops specialist Magify has attracted €1m ($1.11m) in investment from Steam Power Investment. This cash is going to be used to fuel product growth, as well as expansion into new markets and improving the company’s AI functionality.

InMobi raises $100m

Indian adtech firm InMobi has secured $100m in debt financing from MARS Growth Capital. It intends to use the finding to bolster its AI capabilities and make further acquisitions in this space.

Stillfront extends $66.8m credit agreement

Swedish games firm Stillfront has secured an extension of its €60m ($66.8m) loan facility agreement with the Swedish Export Credit Corporation by one year. This was initially signed in September 2022 with a four-year term but an extra year has been added meaning it will now come to an end in September 2027.

63% of devs say Unreal is their engine of choice

Research from Perforce shows that 63% of respondents to a game developers survey say that Unreal is their preferred engine, coming in ahead of Unity with 47%. There’s a very large gap before reaching the next most popular option – outside of proprietary engines – which is Godot at 9%.

Perhaps surprisingly, Unreal was more popular with indie and mid-size developers than triple-A studios (66% vs 59%) while Unity was much more in vogue with smaller creators than larger (52% vs 30%).

When asked what is the biggest challenge facing developers, 36% said funding was the biggest problem, followed by collaboration at 21%.

In a question on AI uptake, ChatGPT is being used at 47% of companies that took part in the survey, but interestingly the second largest option was 34% of respondents saying that the question did not apply to them.